Frictionless 3DS 2.2 Implementation – The Solutions

In the first part of our blogs about 3DS2 implementation (which you can find here), we discussed the key challenges and the importance of a good 3DS2 implementation. In this blog, we will turn to the solutions and take a closer look at what can be done to ensure smooth implementation.

What are the solutions?

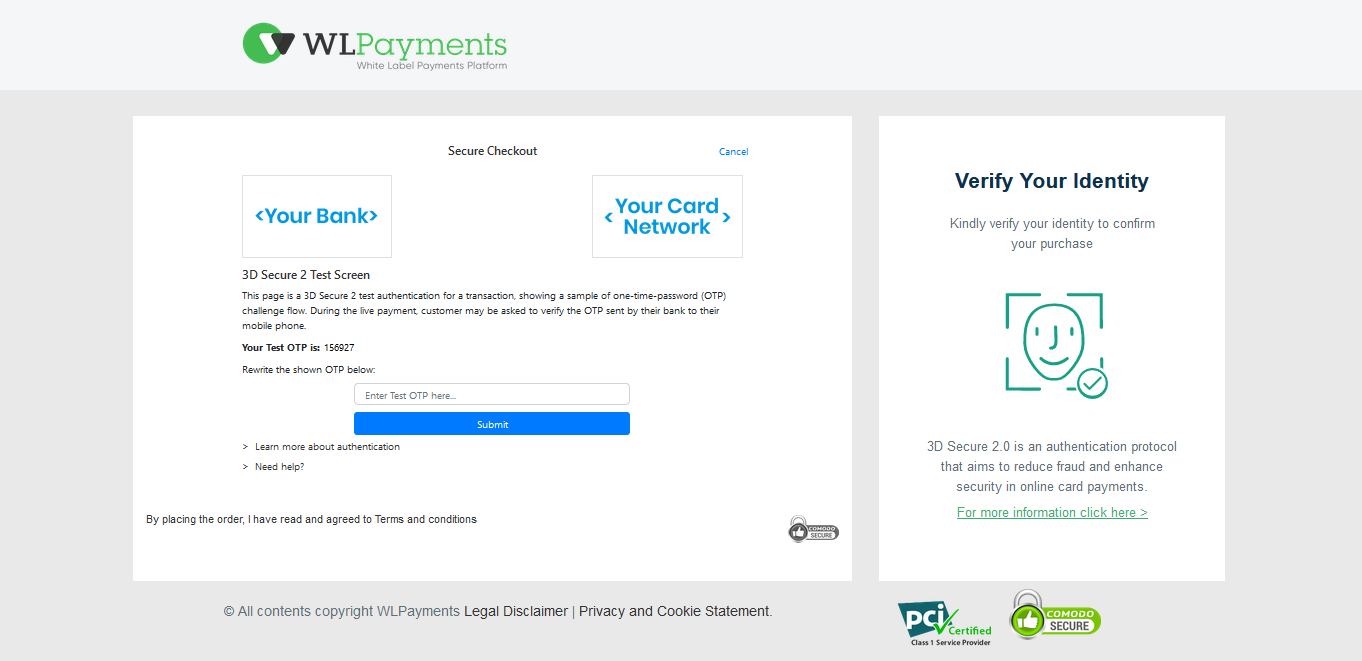

At its core, the whole 3DS2 checkout experience should be smooth – the customer should not feel like they are leaving the merchant website or that their payment is not secure. This can be easily achieved by designing the checkout pages in the same look and feel as that of the merchant’s page, in turn securing the trust of the shoppers. Moreover, the checkout page can educate the shoppers on the new protocol changes by providing a general description on why certain authentication information is required. This could help ease the customers and make the implementation of 3DS2 considerably easier.

In addition, one should look towards the payment companies for solutions as merchants should not have to worry about the frictionless 3DS2 adaptation. Clearly, it is not the main focus of a merchant’s business and can be an especially burdensome task for them even if they are a big player. Hence, good 3DS2 implementation should support merchants, requiring little to no effort from their side. For example, at WLPayments our merchants are only required to add an easy-to-implement injector file provided by our team.

Payment gateways should also pass on as much data as possible to the issuers so that they can increase their frictionless flow. This can greatly increase merchants’ success rates and decrease checkout frictions. Lastly, when banks are not ready for 3DS2, payment gateways should analyze the transactions and instead use 3DS1 for subsequent transactions, reducing the number of errors and declines.

Looking beyond compliance: 3DS routing

At WLPayments, we are constantly looking for innovative solutions to our merchants’ payment issues, which is why we developed 3DS routing. This feature routes transactions to the most efficient authentication protocol, taking into account exemptions and other valuable information. To give an example, if the issuer is not ready for 3DS2, then the transaction will be authenticated with 3DS1. While, if a merchant has low chargeback, 3DS routing will first try the payment with no 3DS and if an error is received, then the payment will be redirected to 3DS.

3DS routing also allows merchants to decide and implement their own 3DS2 strategy. Namely, merchants can choose which transactions they want to pass on to 3DS2, 3DS1, or no 3DS. For regular customers with a small likelihood of chargebacks, merchants can route the transactions to no 3DS, ultimately decreasing checkout frictions and potentially preserving loyal customers. In this way, merchants can determine their own 3DS approach, as after all, they know their customers best. Aside from this, if a merchant is entering a new market, 3DS routing enables them to conduct A/B testing for 3DS authentication. Thus, the merchant can choose to route part of the transactions with 3DS2, some with 3DS1 or no 3DS, in order to make informed decisions and find the most optimal approach that suits their business model and customer segment.

Conclusion

Overall, 3DS2 can provide numerous benefits, but it is important to keep in mind that this is contingent on correct implementation. In fact, there are many challenges associated with the adoption of the new protocol, this process is far from being effortless. Moreover, as we discussed, the challenges are encountered at all levels; at the customer, merchant, as well as bank layers. Therefore, one must consider various solutions that could solve implementation problems and take away the frictions. In our view, payment gateways are in the best position to achieve this as they can bridge this gap and solve implementation issues at all levels. At WLPayments, we follow this approach and aim to mitigate all implementation issues that our clients encounter, while also taking a step beyond compliance through our 3DS routing solution.

Frictionless 3DS 2.2 Implementation – The Solutions

Let's talk about

3DS Solutions

FEATURED PAGES

WLPayments and Payplug Announce Strategic Partnership to Enhance Payment Solutions for Merchants

WLPayments and Payplug Announce Strategic Partnership to Enhance Payment Solutions for Merchants Amsterdam, 4 March 2024 – WLPayments, a leading provider of innovative payment orchestration features, and Payplug, the European payment solution for e-merchants and...

A Closer Look at WLPayments’ Enhanced Rules Engine

A Closer Look at WLPayments' Enhanced Rules Engine Introduction: In the dynamic payment processing realm, WLPayments is excited to announce a significant leap forward by unveiling our upgraded Rules Engine. This enhancement promises to elevate your experience,...

WLPayments now supports MPAN for seamless ApplePay tokenization flow

Feature Update : WLPayments now supports MPAN for seamless ApplePay tokenization flowIn a continuous effort to enhance the payment experience for its users, WLPayments, a leading payment gateway company based in Amsterdam, is thrilled to announce a significant feature...