Innovative

Features

All-in-One

Platform

Data

Security

White-Label

Setup

Super Fast

Integration

White Label Payment Platform

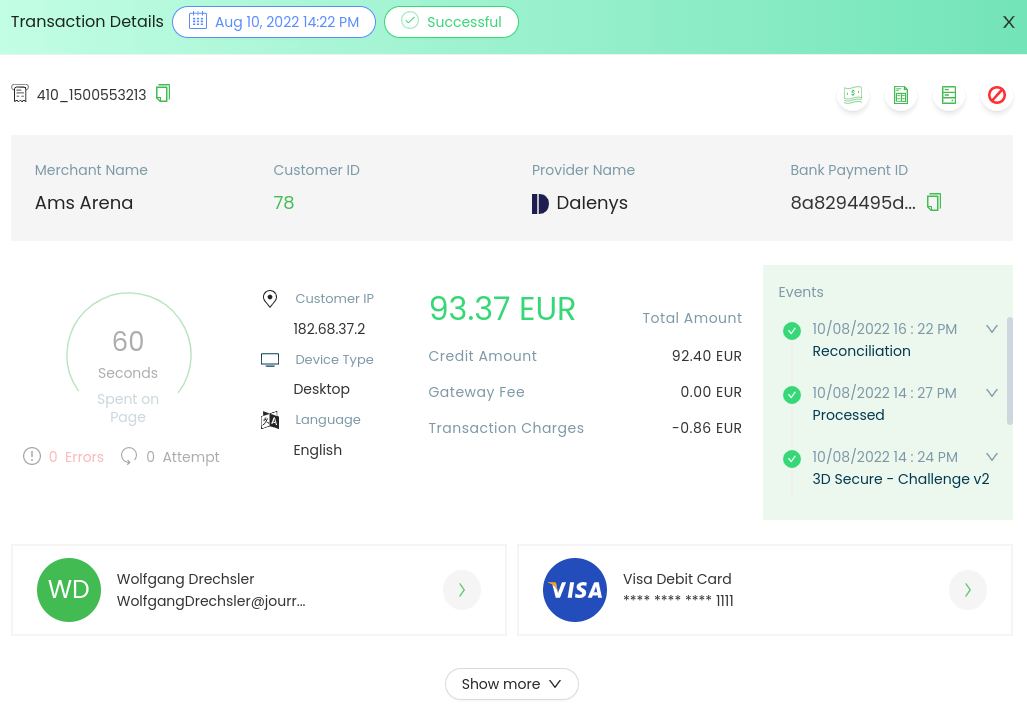

Whitelabel Payment’s Payment Orchestration Platform is the trusted payment orchestration platform that allows merchants to take control of their payment flow through the multi-acquirer set-up. Online merchants can utilise Intelligent Transaction Routing to set custom and effective transaction routing rules to increase the success rate. Real-time In-Depth Reporting data facilitates better decision-making, while Automated Reconciliation ensures no transaction is left unmatched between acquirers.

WLPayments – Trusted White-Label Payment Platform

White Label Payment Platform

White Label Payment Platform

White Label Payment Platform

White Label Payment Platform

White Label Payment Platform

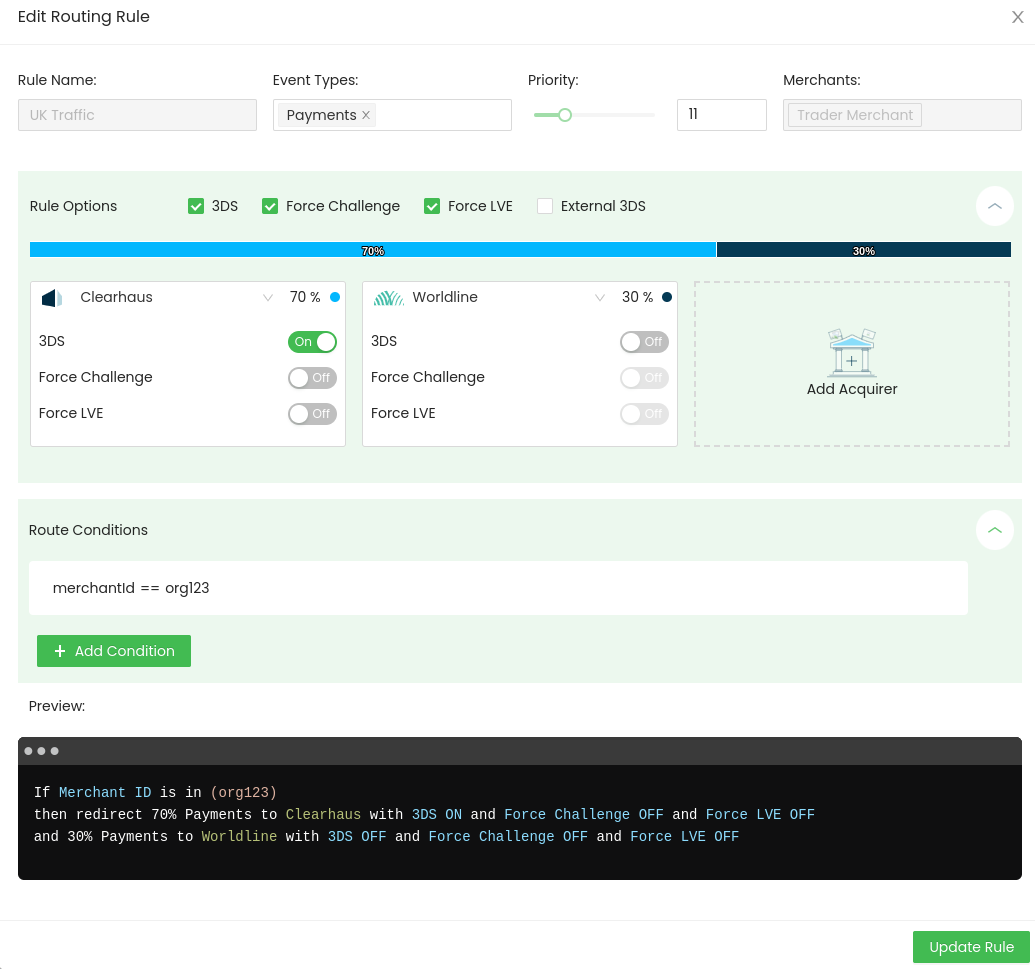

Intelligent Transaction Routing

Control your payment flow by setting effective transaction routing rules

Cascading & Retry

Increase the success rate and make sure no customer is lost due to provider outages

Automated Reconciliation

Save time & cost of day-to-day accounting while increasing efficiency

Flex 3DS & 3DS Routing

Save on high 3DS acquirer fees, and ensure frictionless implementation of 3DS2

Chargeback Management

Prevent fraud, receive chargeback notifications, fully automated

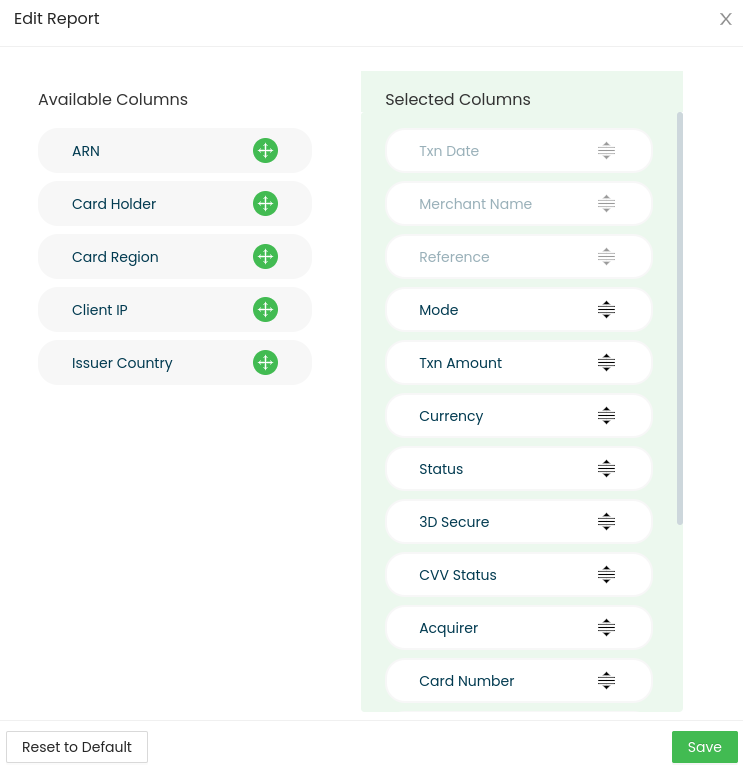

In-Depth Reporting

Utilise real-time transaction data for better-informed decision-making

Flex 3DS & 3DS Routing

Flex 3Ds & 3Ds Improve success rates, lower costs, and stay compliant with Whitelabel Payments payment authentication solution Flex 3DS. Utilise the powerful 3DS Routing engine to implement your own 3DS strategy, while taking into account exemptions. All while ensuring a smooth user checkout experience!

3D Secure

Frictionless implementation of EMV 3DS2 to ensure no transaction is lost with 3DS Routing

Low Value Exemption

Request exemptions from Strong Customer Authentication (SCA) for low-value transactions

Transaction Risk Analysis

Reduce checkout friction by exempting low-risk transactions from additional authentication

No 3DS

Avoid the extra authentication layers and added friction in markets where 3DS is not mandated

Automated Reconciliation

No more unmatched transactions or missing funds

Chargeback Management

Get chargeback notifications and automate refunds to safeguard your MID

Risk Management

Prevent Fraudulent transactions with Fraud Auto-Detection tools

Whitelabel Payments Merchant Portal

Your merchant portal gives you access to all sorts of real-time customer data. This gives you the information you need to make informed decisions. Whether it is in-depth transaction data, chargeback and refund information or acquirer performance statistics, you are in control of your payments strategy and success.

Expand to New Markets

As you want to grow your business, expanding to new markets may be a logical thing to do. But with new markets, you will need new payment methods, localised payment pages and new currencies. Most importantly you need the insights to know what works and what does not and also why. Our platform provides you with what you need to be successful internationally. Learn how.

Local Payment Methods

Our Latest Releases

Frictionless 3DS 2.2 Implementation – Part 1

Using Payment analytics and insights to grow your business

Most popular payment methods in LATAM